Understanding Foreclosures

Talking about foreclosure always instills panic amongst the homeowners. In recent times, mortgage and foreclosure frauds have increased and it has become a necessity for the people to know and understand the process of foreclosure and the ways that they can avoid this case. Additionally, detecting a foreclosure case is very essential for you. It is not wrong to say that the right kind of information would be supplying you with proper defense against frauds. Therefore, we will discuss some basic details about foreclosure.

Talking about foreclosure always instills panic amongst the homeowners. In recent times, mortgage and foreclosure frauds have increased and it has become a necessity for the people to know and understand the process of foreclosure and the ways that they can avoid this case. Additionally, detecting a foreclosure case is very essential for you. It is not wrong to say that the right kind of information would be supplying you with proper defense against frauds. Therefore, we will discuss some basic details about foreclosure.

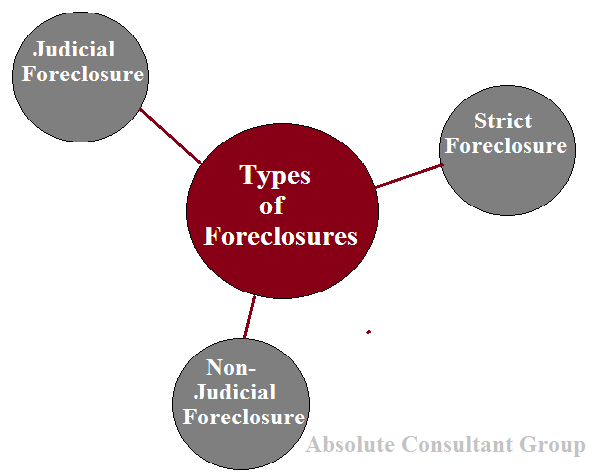

Major Types of Foreclosures:

Let us first understand the different types of foreclosures.

- Judicial foreclosure– This is the kind of foreclosure that we all know about. The lender, who has not received his payments yet will file a lawsuit against the borrower and send him a foreclosure notice. The borrower will be asked to pay a specified sum within a period of 30 days or the property under his possession will be sold off to get the loan amount.

- Non-judicial foreclosure– If your mortgage agreement has a clause called ‘Power of Sale’, then the lender would simply send you a plain notice that the payment is under default and it would be up for foreclosure soon. This is also widely known as statutory foreclosure as the court is not involved and the lender has all the rights over the property until full repayment.

- Strict Foreclosure– this kind of foreclosure is not very common. The procedure is similar to a judicial foreclosure and the borrower is sent a notice along with a date to pay back the dues. Failing this, the lender gets the complete ownership of the property and there is no public auction of the property.

Now, we will understand the rights that you have and the steps that you must take before accepting a foreclosure notice. Remember, that getting such a notice is not the end of the deal. Many people simply get disheartened on getting such a notice and fall prey to the frauds. Therefore, you must first ensure that the mortgage lender has the complete authority to foreclose the property. Whenever you get such a notice, simply respond back and ask for the documents that prove the authority of the sender for such an action. In case they are frauds, they would probably never reply back to you. Even if the reply comes, first go to an attorney and let him check the documents for any kinds of discrepancies. It is only after these processes that you must look for options that may avoid the foreclosure.