Information Disclaimer: Not Your Loan Servicer (Read More)

**We are not affiliated with any mortgage servicer, the investor/beneficiary of your mortgage note, the mortgage insurer (if applicable) or any government agency. We are a homeowner advocacy group with more than a decade of helping homeowners and professionals with mortgage assistance negotiations. The information found on this page is for educational and convenience purposes only. The information found on this page should be considered as opinion and not fact based on our experience with lenders over 10+ years. Consult your mortgage servicer directly or a professional before using any of the information found on this site. If you are seeking an intermediary to assist you in getting help with your mortgage you may contact us at 888-934-3444 or via email at [email protected] for further review for a no fee, no obligation, consultation. If required you may be referred to a local professional or legal counsel for additional assistance with your mortgage. Please read through our Disclaimer page for additional details. We do not represent in any way any financial institution named on this page. If you feel that any of this information has become outdated or is incorrect please contact us immediately.**

Why Quicken Loans Have Highest Satisfaction Level in Primary Mortgage Origination?

Why Quicken Loans Have Highest Satisfaction Level in Primary Mortgage Origination?

2014 U.S. Primary Mortgage Origination Satisfaction Rankings

2014 U.S. Primary Mortgage Origination Satisfaction Rankings

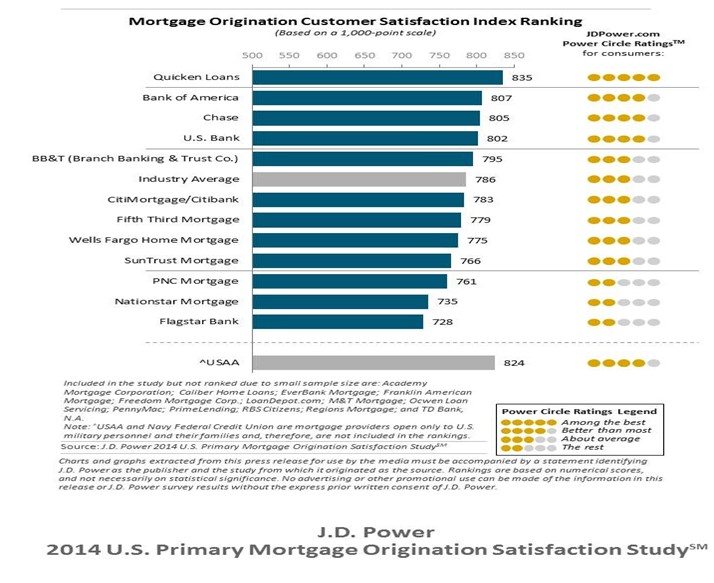

Quicken loans has been raking for the last four years and again got the height position this year as well. They got the highest satisfaction level for the loan origination process with a score of 835. Quicken loans are greatly performing in all the factors. Bank of America got second position with 824 scores, followed by Case with a score of 805. USA achieves a score of 824, but is not award-eligible because it is a mortgage provider open only to U.S. military personnel and their families.

The 2014 U.S. Primary Mortgage Origination Satisfaction Study is based on responses from 3,893 customers who originated a new mortgage or refinanced within the past 12 months. The study was fielded in July through September 2014.

According to the J.D. Power 2014 U.S. Primary Mortgage Origination Satisfaction Study released on 13th November, 2014 the first time homebuyers face and report challenges understanding the primary mortgage process and the options available to them.

The study, which has been restructured in 2014, measures the customer satisfaction with the mortgage origination process in six ways: loan offerings; application/approval process; interaction; closing; onboarding; and problem resolution.

Mortgage Origination Satisfaction Study

According to this study fifty eight percent (58%) are the first time home among survey respondents purchasing a home. Uncertainty and lack of experience and information about the process influence how the first time home buyer inquire about a mortgage, with 48 percent heading to a lender’s local office to meet with a loan representative in person and receive personalized advice.

Recent National Association of Realtors

According to the Recent National Association of Realtors the first time home buyer is well below historical norms. A huge number of borrowers are looking for guidance and assurance so it is critical that lenders are fully prepared to provide the perfect details and information about the mortgage origination process. Craig Martin, director of the mortgage practice at J.D Power said

“The loan representative is the face of the organization for most borrowers and is relied upon to provide effective explanations, set accurate expectations and ensure consumers have confidence that they are making a good decision.”

Key Points

Overall customer satisfaction with the mortgage origination process averages 786 (on a 1,000-point scale) in 2014.

Transparent Mortgage Process

Customers urges to be given a transparent mortgage process. Forty three percent (43%) first time homebuyers and thirty five percent (35%) of all mortgage customers reported that they don’t properly understand the mortgage origination process, resulting in an average decline of 179 points in overall satisfaction.

Understanding of the Process

Fifty four percent (54%) of the first time homebuyers responded that they don’t perfectly understand the different loan options available to them. Only the fifty six percent of experienced (56%) and forty one percent (41%) first time homebuyers reported that their representatives properly explained the available types of loan, terms, special programs, options to reduce the down-payment and fees.

Continuous Communication

Continuous communication between lender and borrower is another important part of the mortgage origination process. When loan representatives fail to call customers back as promised it caused a fall in customer satisfaction by 236 points.

Closing Experience

The closing experience is often confusing for customers. Among first-time homebuyers, 44 percent indicates that the closing agent didn’t completely explain all of the closing documents vs. 26 percent of experienced customers. Overall satisfaction declines by an average of 144 points when lenders fail to effectively communicate loan documents and terms.

Human Interaction

The study indicates that the loan representative is still a key element of the process keeping in mind that a huge number of customers obtain information and updates online by using mobile and devices. Online information cannot deliver the great customer experience and it requires a human interaction.

Challenge with First-Time Homebuyers

The first time homebuyers may be afraid to appear unfamiliar and even sometimes don’t accept that they don’t understand the process properly that is a potential challenge as well. From describing what will happen during the process in terms a customer can understand to explaining the benefits of available choices, the loan representative defines the tone of the practice. The lending staff must be open and encouraging that invite the friendly communication and borrower can ask as many as questions they want. In this way they will be in a better position to understand the process