Information Disclaimer: Not Your Loan Servicer (Read More)

**We are not affiliated with any mortgage servicer, the investor/beneficiary of your mortgage note, the mortgage insurer (if applicable) or any government agency. We are a homeowner advocacy group with more than a decade of helping homeowners and professionals with mortgage assistance negotiations. The information found on this page is for educational and convenience purposes only. The information found on this page should be considered as opinion and not fact based on our experience with lenders over 10+ years. Consult your mortgage servicer directly or a professional before using any of the information found on this site. If you are seeking an intermediary to assist you in getting help with your mortgage you may contact us at 888-934-3444 or via email at [email protected] for further review for a no fee, no obligation, consultation. If required you may be referred to a local professional or legal counsel for additional assistance with your mortgage. Please read through our Disclaimer page for additional details. We do not represent in any way any financial institution named on this page. If you feel that any of this information has become outdated or is incorrect please contact us immediately.**

PNC Mortgage Bank Application, Forms And Packages

PNC Loan Modification

PNC Short Sale

Other Mortgage Assistance Programs

Get PNC Mortgage Froms

PNC Loan Modification

PNC Mortgage Short Sale

PNC Mortgage Bank Loan Modification Package, Application and Forms

What is a PNC Loan Modification Package?

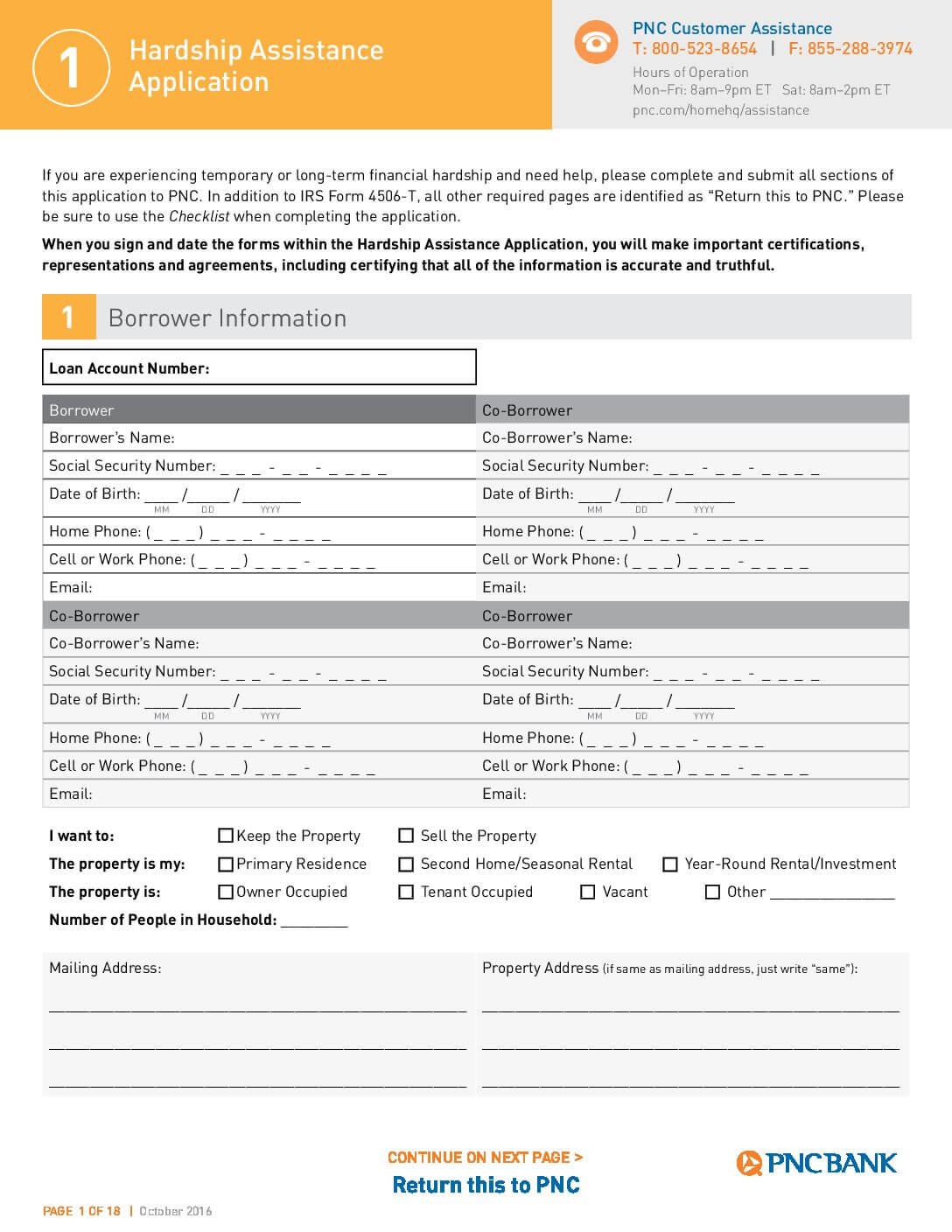

PNC Mortgage has a hardship application for borrowers struggling to make their mortgage payment. They require this document to be completed in order to apply for mortgage relief assistance. PNC Loan Modification Package commonly referred to as the RMA or Request for Mortgage Assistance but specific to PNC Mortgage they call it the Hardship Application. It includes a Hardship Letter or Affidavit built in so you will not need to add any additional documents to the application unless you choose to. Forms are constantly being updated and change often, before applying for mortgage relief assistance you have to use the latest paperwork; That’s why before using any forms found here on the site speak to one of our professionals or your single point of contact at your lender. The applcation forms we were last provied were uploaded here on the Absolute Consultant Group(ACG) website for educational purposes only. Absolute Consultant Group prides itself on being a premier mortgage assistance relief service where we help homeowners like you with their PNC Mortgage Loan Modification process and we can help you too.

PNC Mortgage has a total of 5 sections on their standard PNC Loan Modification Package and totaling about 18 pages. Let us know if you have any questions by calling us at 888-934-3444; We’re here to help!

Need Assistance With A PNC Morgage?

Need Assistance With A PNC Morgage?

PNC Mortgage Hardship Application (RMA) Request for Mortgage Assistance Programs Package Breakdown:

Hardship Applicaiton (18 Pages)

- Borrower Information This first section covers the basic information of the PNC Mortgage borrower’s applying for mortgage assistance. You need the information for all the borrowers that appear on the mortgage on this page in order to complete the application. It covers whether you want to keep the property or sell it. Furthermore, they establish if this is your primary residence, second home or an investment property. Each type of property may carry it’s own type of options for assistance. The clarify the number of residents in the property and the residency type amongst other things.

- Customer, Credit Counselor (HUD), Bankruptcy, and SCRA Servicemembers Civil Rights Act Information In this area you fill out some basic information as well such as your loan number. There is a section that asks if you have been speaking to a credit counseling agency what their number is and who is the person you spoke to. They also try to clarify if you have filed for bankruptcy so they can get you to the right department and follow the correct protocol. Finally, If you’re on active duty this section is for you. On the hardship application they try to get your basic status if you have been deployed or not.

- Power of Attorney The third page asks you to include any power of attorney attached to the package for their files.

- Property Details (Listing) This section starts off by asking if the property is currently listed for sale. It also includes a third party authorization and approval to speak to any one that is representing the property.

- Property Details (Offer Received, HOA and Taxes Details) (Continued) The page that follows in the hardship application for mortgage assistance is whether or not an offer has been received. If your property is not listed for sale this section doesn’t apply to you but there are some parts that might. This area also covers whether you have a HOA (Homeowner’s Association Dues) and whether your property taxes are escrowed into your account along with what the annual amount is.

- Property Details (Additional Mortgages) (Continued) The property details sections in the request for mortgage assistance by asking what other mortgages may be on the property and their contact information.

- Property Details (Use Of Property) (Continued) The property’s use is further clarified in this section. They find out if it’s vacant or rented along with whether or not it shows up on your tax returns. They ask you proof of it being rented including two month’s bank statements showing the deposits and the lease agreements. At the bottom of this page they ask whether there is a loan on your primary residence, who you make the payments to, if you are delinquent on that mortgage and if you are are behind on your mortgage how many payments that it’s behind.

- Hardship Details, Documentation and Written Explanation (Start Date and Hardship Check boxes) This is where PNC Mortgage really starts trying to get to the meat of the situation. They try to establish when the hardship began and what the hardship is by providing a series of options for the borrower to check.

- Hardship Details, Documentation and Written Explanation (Hardship Length Expected and Written Hardship Letter) This area allows you to advise PNC Mortgage of how long you think you will be affected by the hardship. They ask that you write financial hardship letter in the area provided but if it’s not enough room you can always add additional pages.

- Income Documentation (Financial Breakdown) PNC Mortgage Hardship Package Income Documentation Section – This area gives you very basic form to fill out all the different forms of income you have in the first column. The next column gives you again very basic place for you to summarize all the different monthly expenses you have. Lastly, in the column on the right you have a place to document all your assets. This is one of the most important parts of your hardship application because when it comes to mortgages it’s all about the numbers and your ability to afford the payment being given to you.

- Income Documentation (Supporting Documentation) (Continued) The next two pages of PNC’s Request For Mortgage Assistance (RMA) Form is a breakdown of the different income types and the type of proof of income that they require for each.

- Income Documentation (Other Properties Owned) (Continued) This section requires the homeowners to list any other properties owned and the details surrounding those properties.

- Borrower Acknowledgement This has a series of disclosures that are required to be signed by the borrower and co-borrower in order to apply for mortgage assistance.

- 4506T – The final document required prior to the fax cover letter provided is the 4506-t which is used in order to verify the tax returns that you provided. Make sure to follow the directions throughly.

We’ve helped homeowners like you. Have any questions? Call 888-934-3444. No obligation, free consultation.

Understanding Your PNC Mortgage Loan Modification Status

The PNC Hardship Application to request for mortgage assistance along with supporting documentation for your Loan Modification Package is a lengthy to say the least. PNC Mortgages aren’t easy to apply for assistance but that’s why ACG is here to offer you the direction you need to manage the assstance process to get mortgage relief from your home loan lender. Your PNC’s Loan servicing division has various locations.

PNC Short Sale Package Forms

In most cases PNC Loans uses the same package for loan modifications as it does for a PNC Short Sale application. The paperwork for doing a short sale with your PNC Mortgage will require additional documentation related to the sale such as the purchase agreement and settlement statement which lets PNC Mortgage and the investor they represent know how much they will receive from the offer being made but the short sale buyer.

Not just anyone can manage the short sale negotiation like us. While it’s a careful balanace of dealing with PNC Mortgage Bank’s mortgage servicing department or dealing with real estate professionals and keeping everyone happy it takes a learned skill set that you only get from dealing in the volume of short sales we have. For over a decade we have specialized in this area and represent many of the largest brokers/agents in the business.

Call Us 888-934-3444 Today.

PNC Mortgage Help For Homeowners

PNC Mortgage offer many types of help to borrowers:

PNC Home Mortgage Loan Modification

PNC Mortgage Short Sale

PNC Mortgage Is Difficult. Don't Go It Alone. Professionals Standing By.

Disclaimer: Using The Wrong Form May Lead To A Denial

[contact-form-7 id=”30196″ title=”Site Wide Package Disclaimer”]