your kids play around and you spend day and nights with your loved ones. This is a place which has an emotional attachment and you never want to lose this sweet home.

At the time of buying and decorating home you never think that someday you will be forced to sell or leave this home. But, it happens. Life is unpredictable and it plays with us. The financial crises come and disrupt your life. You had mortgage and signed the terms to pay your monthly installment to lender. In financial downfall you are unable to pay your mortgage and want to avoid legal complications. There are two options, first one is short sale and the second one is foreclosure.

Short Sale:

“A short sale is a transaction in which the bank lets the delinquent homeowner sell the home for less than what’s owed. The borrower finds an agent and puts the house on the market, often at a substantial discount.”

The idea behind this deal is that if the home sells, the lender will recoup the sufficient amount that was lent. A short sale doesn’t release the borrower from the debt he or she incurred with the original mortgage, but it can be better than a full-on foreclosure.

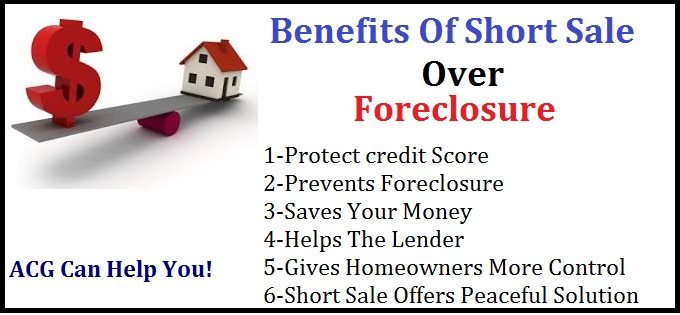

Benefits of Short Sale over Foreclosure:

There are a number of benefits of short sale over the foreclosure. Some of the major benefits are discussed here:

Protect credit Score:

In case of foreclosure you may have a deficiency judgment. In this scenario foreclosure abolishes your credit score and leave a long lasting bad impact on your credit history. But, short sale can avoid having bad remarks on your credit statement. The only problem with a short sale is you may have to wait couple of months and you also need to get approval from lender before proceeding short sale.

Prevents Foreclosure:

Foreclosure is the worst thing that can happen and effects a borrower in a number of ways. Borrower not only losses his or her home, but also may lose job and along this has a negative impact on credit statement. Until you recover your credit score you may not be able to apply for new mortgage, car loan and some other kind of financial assistance. Short sale can save you from all such kinds of worries preventing foreclosure. Short sale enable you to apply for new mortgage after clearing the first mortgage and you have access to all financial assistance programs.

Saves Your Money:

Foreclosure is a really costly solution to mortgage. According to the U.S Congress Joint Economic Committee the average cost of foreclosure is around $75,000 accompanied with a lot of other legal costs. During a financial downfall it is impossible to pay such kinds of heavy amounts and you are not left with many options. The Foreclosure eventually may lead to bankruptcy and many legal complications. Short sale is the smart solution that saves your money, avoid bankruptcy and legal complications.

Helps The Lender:

Foreclosure not only impact the borrower, but also has negatively effects on the lender. The lender also incurs the cost of sending different notices to borrower before the proceeding to foreclosure. The lender also needs to hire foreclosure consultant and attorney in case of foreclosure proceeding. The lender also have to wait to free up the mortgage amount. However, in opting for a short sale, the lender can recover a portion of the money that’s owed on the property, thus reducing the loss without the extensive legal process of a foreclosure. Most of the time short sale reduces the overall loss of lender.

Gives Homeowners More Control.

After the start of foreclosure process, borrower gets under the pressure of legal notices, confusing documents, demand notices and continuous meetings with legal team. In a short sale, there are still negotiations, meetings and paperwork for the homeowner to weave through. The process of short sales plays out more like a traditional sale, as opposed to a litigious and pressure-packed foreclosure proceeding. The short sale process allows borrower to demonstrate an active role, specifically with bank, short sales consultant and home-buyer. Short sale provides much more control to borrower as compared to foreclosure that leave the borrower on the mercy of bank attorneys.

Short Sale Offers Peaceful Solution.

Short sale offers the seller a peace of mind as compared to foreclosure. The major credit hit, the drawn-out legal process and the overall stigma attached to foreclosure can be quite unnerving. Foreclosure also effects the lender and borrower in a number of negative ways, but the short sale offer a peaceful solution to seller.