Information Disclaimer: Not Your Loan Servicer (Read More)

**We are not affiliated with any mortgage servicer, the investor/beneficiary of your mortgage note, the mortgage insurer (if applicable) or any government agency. We are a homeowner advocacy group with more than a decade of helping homeowners and professionals with mortgage assistance negotiations. The information found on this page is for educational and convenience purposes only. The information found on this page should be considered as opinion and not fact based on our experience with lenders over 10+ years. Consult your mortgage servicer directly or a professional before using any of the information found on this site. If you are seeking an intermediary to assist you in getting help with your mortgage you may contact us at 888-934-3444 or via email at [email protected] for further review for a no fee, no obligation, consultation. If required you may be referred to a local professional or legal counsel for additional assistance with your mortgage. Please read through our Disclaimer page for additional details. We do not represent in any way any financial institution named on this page. If you feel that any of this information has become outdated or is incorrect please contact us immediately.**

Specialized Loan Servicing (SLS) Application, Forms And Packages

SLS Loan Modification

Need Help With Your Specialized Loan Servicing Loan Modification?

SLS Short Sale

Need Help With Your Specialized Loan Servicing Short Sale Process?

Other Mortgage Assistance Programs

Here’s Are Few More Services Offered By ACG And It’s Network.

Get Specialized Loan Servicing Froms

Need The Specialized Loan Servicing (SLS) RMA Package? You’ve Come To The Right Place.

Specialized Loan Servicing Loan Modification

Need Help With Your Specialized Loan Servicing (SLS) Loan Modification? Get More Info Here.

Specialized Loan Servicing Short Sale

Need Help With Your Specialized Loan Servicing (SLS) Short Sale? Get More Info Here.

Specialized Loan Servicing (SLS) Loan Modification Package, Application and Forms

What is a SLS Mortgage Loan Modification Package?

Specialized Loan Servicing, Inc. (SLS) requires a particular package to be filled out when applying for mortgage assistance. SLS Loan Modification Package commonly referred to as the RMA or Request for Mortgage Assistance includes a Hardship Affidavit built in. As the forms change regularly, when applying for mortgage relief you have to use the latest paperwork; Before using any forms make sure you check with a professional or someone at your lender. The package and forms we last found were put up on the Absolute Consultant Group(ACG) website for educational purposes. Here at Absolute Consultant Group we help homeowners with their Specalized Loan Servicing (SLS) Mortgage Loan Modification process and we can help you too.

There are 8 sections to the standard SLS Loan Modification Package and totaling about 16 pages; There are also check lists, additional resources, and a Servicemembers Civil Rights Act Notice.

Need Assistance With A SLS Morgage?

Need Assistance With A SLS Morgage?

SLS (RMA) Request for Mortgage Assistance Programs Package Breakdown:

Mortgage Relief Application Check List

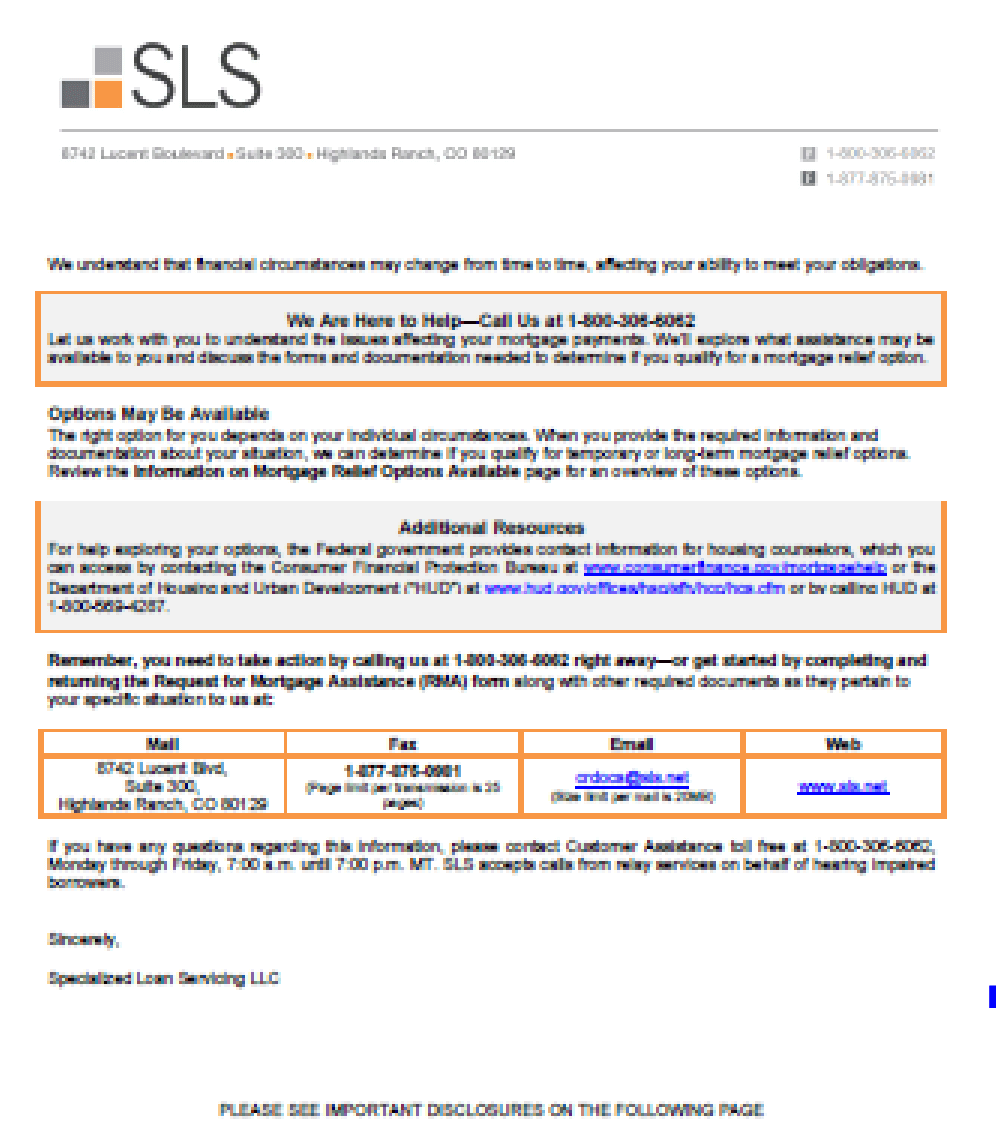

- Additional Options And Information The first page gives you a breakdown of where to call to reach SLS’s mortgage assistance department. They also provide you the SLS Mailing Address for where to send your application to get help with your mortgage while offering you an SLS Email address as well as their Fax to submit your documents. You’ll also find all the standard HUD disclosures you might come to expect to find in these packages. This page is followed by a few additional disclosures in respect to if you’ve filed bankruptcy and a Federal Equal Credit Opportunity Act disclosure.

- SCRA Servicemembers Civil Rights Act Disclosure If you’re on active duty this is for you. It discusses when certain rules apply to you and the limitations allowed by law when it comes to servicing your mortgage.

- Mortgage Assistance Application Check List Now this one can get a little confusing. There is a long list of items that will be required in order for you to apply for help with your mortgage. This details a list of what is needed but if you have any questions that is what our staff here at ACG is help you with.

- Mortgage Relief Options Available This page details a list of the typical options available for mortgage assistance. It lists Reinstatement of your SLS Loan, Specialized Loan Services Repayment Plan, SLS Loan Forbearance Plan, SLS Mortgage Modification, SLS Short Sale, and Deed in Lieu of Foreclosure of your SLS home loan.

- Frequently Asked Questions This section details many of the regularly asked questions when it comes to seeking help with your SLS Mortgage.

- Government Assistance SLS servicing provides a list of government agencies you can contact to see if they can provide you support.

- Section 1-3 RMA – Borrower Information – This is where the application really begins and this section basically requires the Specialized Loan Servicing (SLS) customer to put their homeowner contact information, describe the household as to how many people living in the home, their bankruptcy history, and a brief run through of basic information. Additionally they like to know if any other mortgage has received government assistance (HAMP). It also asks about SCRA if you’re on active duty.

- Section 4 SLS Mortgage Borrower Financial Information Breakdown – In this section of your SLS Loan assistance package it asks for your monthly budget. They want to know everythin they can including your gross/net income. This section also considers if you want to include non-borrower contributors in the budget. You must write down a list of your assets for consideration. This includes but is not limited to, bank checking accounts, and anything else you have of value. In this area you have to make sure you cover everything that is part of your monthly expenses spanning from food to utilities to child costs.

- Section 5 Required Income Documentation – This is a section that specifically outlines, based on the different types of incomes the borrower may earn, what type of supporting documentation will be needed for each. Proving income is one of the most important to seeking assistance with your SLS Mortgage. bank asks to know if this is your primary residence, if you are planning to keep it or if it is up for sale, and more information about the property itself.

- Section 6 SLS Package – Other Properties Owned – SLS requires to know everything about you in order to properly help service your loan and help you find a solution and avoid foreclosure. They ask that you list any properties you own. They need to know the upkeep, homeowners association dues, taxes, and insurance. Furthermore, on each property they need to know if they are vacant, second or seasonal home, or if it’s rented.

- Section 7 SLS Request For Mortgage Assistance (RMA) Form – Hardship Affidavit – This area you give your SLS Mortgage information about what caused you to default on your home loan and if where you are in the process of resolving your hardship.

- Section 9 Borrower Acknowledgment and Agreement – read through these statements as Specialized Loan Servicing and their investor will require you to agree to them. Make sure you sign and date the document

- Section 9 Continued Government Monitoring – This section basically wants to know your herritage (Race) though they cannot use this information to discriminate you.

- 4506T – The final document in the whole page is the 4506-t which is used in order to verify the tax returns that you provided. Make sure to follow the directions throughly.

We’ve helped homeowners like you. Have any questions? Call 888-934-3444. No obligation, free consultation.

Understanding Your Specialized Loan Servicing (SLS) Loan Modification Status

The SLS Request For Mortgage Assistance in conjunction with your supporting documentation for your Loan Modification Package is a lengthy to say the least. SLS Loan Servicing Mortgages aren’t easy to apply for assistance but that’s why ACG is here to offer you the direction you need to manage the assstance process to get mortgage relief from your home loan lender. Your SLS Loan servicing division has various locations, the company though is headquartered in Highlands Ranch, Colorado with an office in Tempe, Arizona.

SLS Short Sale Package Forms

In most cases SLS Loans uses the same package for loan modifications as it does for a SLS Short Sale application. The paperwork for doing a short sale with your SLS Mortgage will require additional documentation related to the sale such as the purchase agreement and settlement statement which lets Specialized Loan Servicing, LLC. and the investor they represent know how much they will receive from the offer being made but the short sale buyer.

Not just anyone can manage the short sale negotiation like us. While it’s a careful balanace of dealing with Specialized loan services mortgage servicing department or dealing with real estate professionals and keeping everyone happy it takes a learned skill set that you only get from dealing in the volume of short sales we have. For over a decade we have specialized in this area and represent many of the largest brokers/agents in the business.

Call Us 888-934-3444 Today.

Specialied Loan Services Mortgage Help For Homeowners

SLS Mortgages offer many types of help to borrowers:

Specialized Loan Services Home Mortgage Loan Modification

SLS Short Sale

Specialized Loan Servicing Is Difficult. Don't Go It Alone. Professionals Standing By.

Disclaimer: Using The Wrong Form May Lead To A Denial

We provide mortgage servicers mortgage assistance package, forms, and applications to for educational purposes only. This is a sample document used to obtain mortgage assistance relief workout programs with your mortgage servicer. Prior to completing the form contact your (your client's) Mortgage's servicing department OR one of our professionals at 888-934-3444 to make sure they are sending the right loan modification or short sale package. Your home loan servicer, whether dealing with a Home Loan Modification or Short Sale (mortgage settlement, short pay off or discounted payoff) RMA Package offered on this website may not be the correct package depending on your investor. By downloading this RMA (Request for Mortgage Assistance) from our website does not guarantee loan modification assistance or any other mortgage relief programs to try to avoid foreclosure through mortgage servicer, its agents, employees, affiliates or subsidiaries. Prior to the use of any documents you should consult an attorney.